Field service invoicing has a close connection to your business’s success. The better and faster you get at invoicing and the better experience you create for your customers, the sooner you will get paid. Make sure you and your team know these following do’s and don’ts to optimize invoicing at your company.

1. Do Text Invoice Reminders to Customers

Text messages have a 98% open rate. Further, only 6% of people reply to emails. When you use SMS, you ensure that your customers will see your message promptly. In fact, you can expect responses from about 45% of your customers. Just make sure to get permission from your customers first. A good way to do it is soon as they accept a job. Ask if they are open to receiving job updates and appointment reminders via text. Then when you text them a reminder or a link to pay their invoice, they won’t be surprised to hear from you.

2. Don’t Rely On Emailed Invoices Without Doing This First

If you are just emailing your invoices and not using SMS (text messaging), know that nearly half of emails are spam, so it’s not surprising that email open rates rarely exceed 20%. If you email your clients their invoices, know that they may miss your messages.

Customers on Gmail, for example, can click on one of your emails and go to the 3-dots to the right corner (above the email’s subject line) and hit “Add to Contacts list” to ensure you land in their primary inbox. Be proactive and ask them to add you to their contacts so you don’t continue to land in their spam folder. Again, you can quickly do this at the time they sign up for your service.

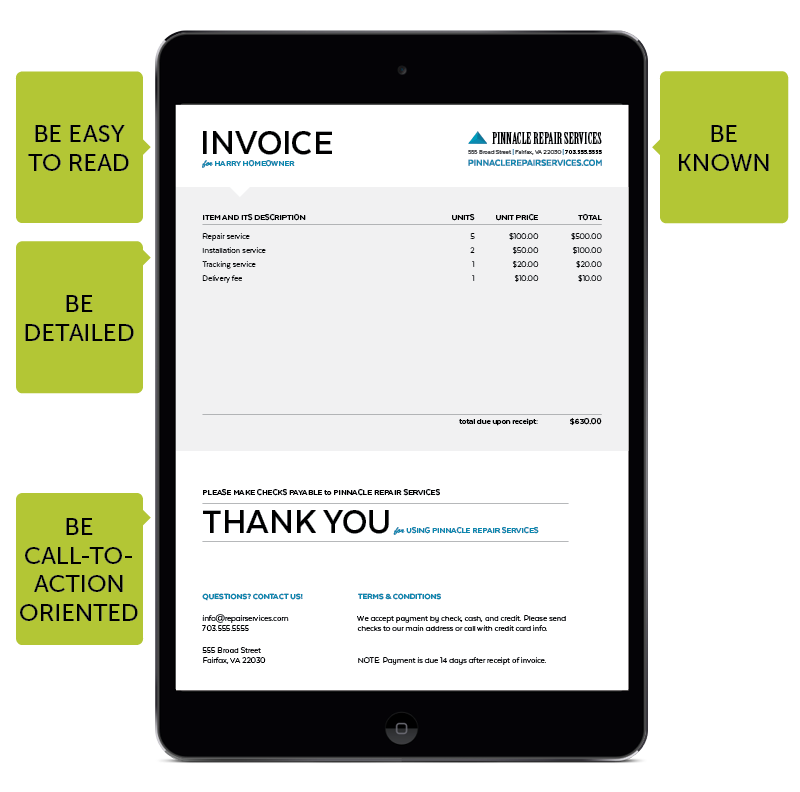

3. Do Personalize Your Field Service Invoices

Branding your field service invoices makes sure that homeowners and other clients remember your company and that they have your important information. When making your invoice template, include your name, logo, and other identifying information that will help people remember you.

If you’ve got the space, you can also include awards your company has received, along with affiliations or groups you’re associated it that speak to your credibility and good standing. Think of your invoice (and even estimates) as another useful marketing document for customers.

4. Don’t Send Your Invoice to the Wrong Client

As your business grows, your list of clients can get out of control. Keep your client contact information organized and updated. Otherwise, you may send your invoice to the wrong person, which sometimes happens more than you think. Of course when your customers don’t receive their invoices, they don’t have any reason to pay you.

5. Do Send Invoices as Soon as You Complete Jobs

Send invoices to your clients as soon as you finish a job. This is easy to do with field service software that can enable you and your team to quickly create and email invoices, and send automated notifications and alerts to your customers. By getting paid quickly, you can improve your business’s cash flow to pay employees, invest in new equipment and more.

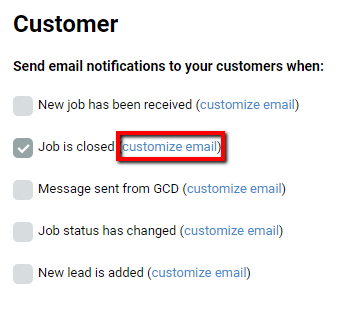

Set up Automated Notifications to Customers in mHelpDesk

as Soon as a Job is Done

Here’s how: go to Settings > Notifications and go to the Customer section you see here below and select Customize Email under “Job is closed” and set up the message for your customers.

6. Don’t Include Too Much Information on the Invoice

An invoice should include a few key pieces of information, including the work done and the job’s price. Including too much information can make the invoice look cluttered and confusing for some people to read, or make sure to have the most important information at the top. If you want to add a friendly message, additional instruction, or helpful information, use a link that will direct the client to more details.

An important thing to remember that some service pros forget is to spell out your payment terms well. In my ways, it’s better to lay it out in simple terms on the invoice, saying for example, “All payments are due within 30 days of invoice receipt.” instead of using lingo, like “Net 30” or “2/10 Net 30”, which can confuse customers.

7. Do Follow Up on Unpaid Invoices Within a Week

Some experts estimate that 16% of small businesses never get paid for their work. Stay in contact with your clients to get paid on time and avoid cash flow problems. If you haven’t received payment within a week, then your client needs a reminder. With the right field service app, you can set this up from the get-go and never forget to remind your customers to pay.

8. Don’t Be Afraid of Issuing Late Payment Penalties

As a business owner, you may not want to have to charge late payment penalties, but it’s wise to have a late payment policy in place that you can enforce if need be. The amount doesn’t have to be large. You could do as little as 1% or 2% of interest per month after the payment due date or just enough to convince customers to pay sooner than later.

9. Do Graduate to a Mobile App When Ready

Text messaging invoicing and dispatching doesn’t require smartphone technology. You can send SMS invoices with any text-enabled phone, but it is still super manual. When you’re ready to speed up or automate your day-to-day processes and tasks, many of which can be repetitive and slow, you should think about graduating to a mobile app that will set you up with electronic invoicing and make job and customer management so much easier. Start with a quick demo to about the technology and what the benefits can be for your company.

How to create, view and email an invoice in mHelpDesk (and get paid!)

10. Don’t Forget to Include Payment Options

Let your customers know what payment options you accept. Ideally, you should accept mobile payments, along with online credit card and ACH payments that make it easy for people to pay you on time. If you have clients with recurring jobs like mowing lawns or cleaning offices, then you should let them set up automated billing that lets them pay you without thinking about it.

Need a better invoicing solution?

With mHelpDesk, you can create and send invoices on the go, collect customer payments and integrate your QuickBooks account, all saving you time and effort. Schedule a free demo of mHelpDesk today!

Last modified: May 24, 2019