![]()

In the field service industry, being able to satisfy your customers continuously is a top priority for most business owners. While prompt service and thorough staff training is typically a recipe for happy customers, many businesses forget about the additional benefits that mobile payment solutions can bring to the overall customer experience.

Here are three reasons why field service companies should adopt mobile payment technology into their business model.

![]()

Offer More Convenience For Customers

Customer service is the backbone of the field service industry and creating convenience for your customers wherever possible is critical. Mobile payments make it easy for customers to pay for their services right away through a variety of different formats. Most people have moved away from using cash and checks and prefer more secure ways of payments. In fact, there has been a rise of nearly $500 billion over the past four years in global mobile payments, leading many businesses to adopt the technology. Imagine completing a job and taking the payment right onsite using your favorite mobile device. It’s convenient for both you and your customers!

![]()

Save Money and Reduce Paperwork

Digital transformations have become the norm for businesses in recent years, and the field service industry is no different. Part of this transition is by optimizing and upgrading older technology that has fallen obsolete. Mobile payment solutions through smartphones and other devices are much more affordable than older, bulkier payment processing systems and considerably cut down on operational costs for businesses. These solutions also cut down on the need for additional invoice paperwork and filing as everything is handled digitally.

Did you know? mHelpDesk users have the advantage of having integrated payment processing with their mHelpDesk account. You won’t have to deal with entering data into a 3rd party payment processor either.

![]()

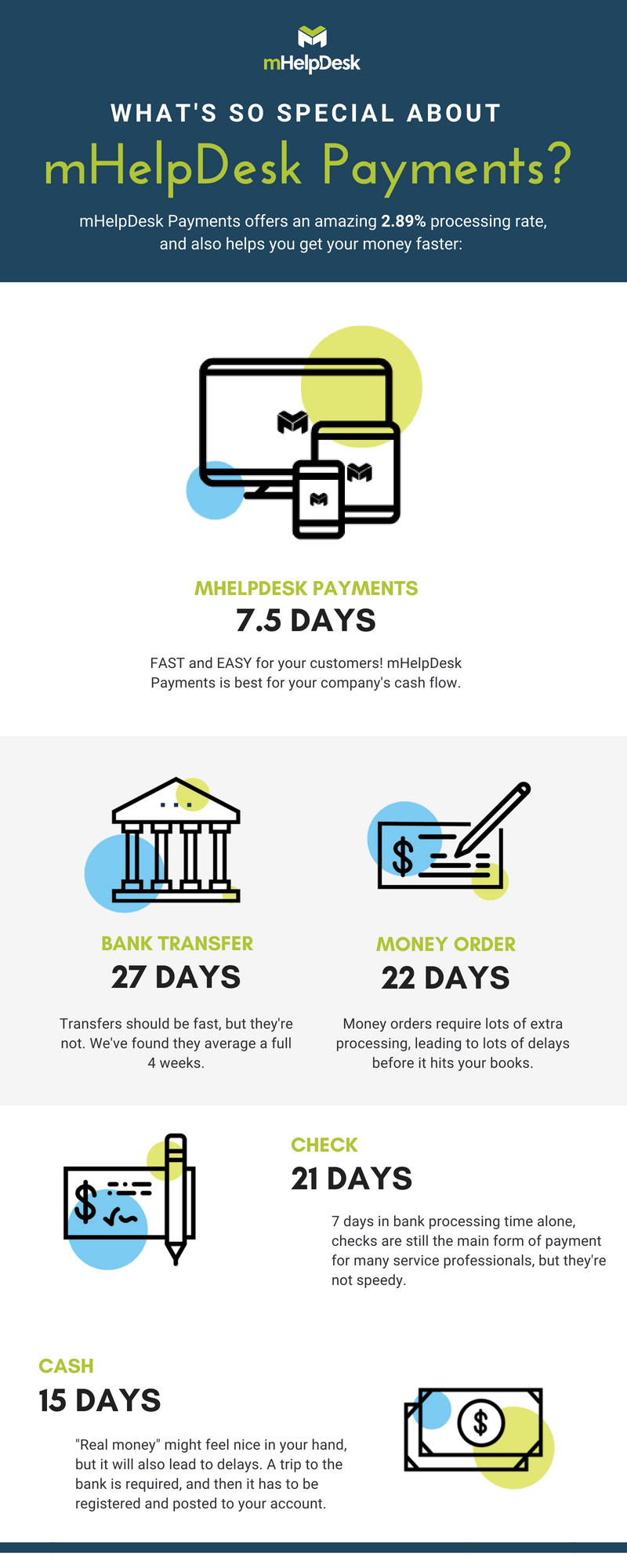

Get Paid Faster

Traditionally, once service appointments were finished, the customer would be invoiced and billed on a later date. However, these gaps of anywhere between 7-30 days could mean a higher likelihood of delayed payment, significantly affecting business cash flow. Now, more than 80 percent of all transactions are being completed using cashless payment systems. This shift in purchasing behavior signals the need to move to mobile payment solutions, which offer a great way to offer a convenient and secure form of payment for customers while reducing the operational load of businesses and improving their cash flow.

mHelpDesk Users: Set Up to Collect Mobile Payments Now (It’s Easy!) >>

New to mHelpDesk? Get a Live Demo of Our Mobile Payments Solution >>

‘

Still operating on pen and paper? Your competitors aren’t.

48% of field service businesses are doing things more efficiently and winning more jobs.

Schedule a free demo of mHelpDesk today!

Last modified: August 16, 2018