Some field service pros are senselessly losing thousands of dollars a year… and don’t even know it.

The devil is in the details.

Some service pros think they’re getting “low” rates from standalone payment processors to process their customers’ payments.

However, the “low” rates advertised by Square and other payment processors are ONLY for swiped transactions. Any other kinds of payments have higher rates.

The problem is that most service pros are emailing or sending out invoices to customers, so they are really paying more–sometimes a LOT more–in processing fees than they realize.

Payment processors also charge even more for payments that are manually keyed in.

But there’s some good news and we’ll get to that in a bit.

What You’re Actually Being Charged

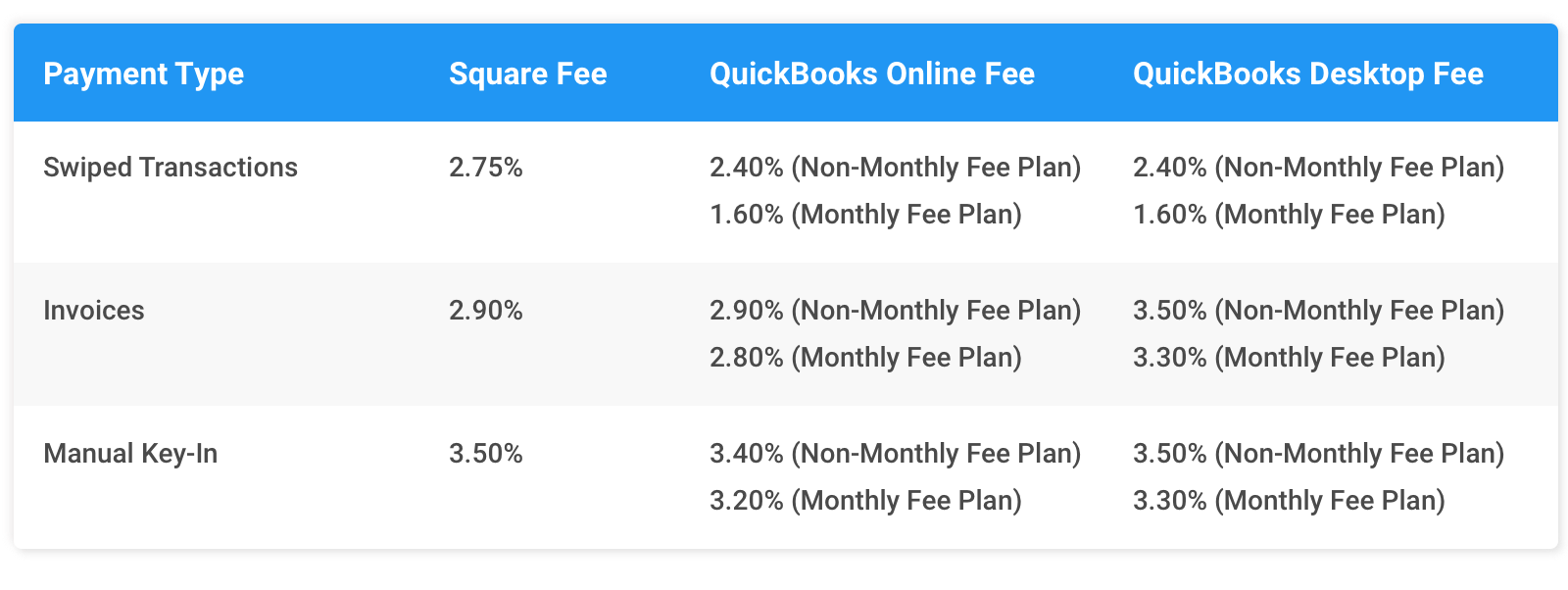

Here are some of the key rates from Square and QuickBooks, two popular payment processors used by service pros:

Source: Square, Intuit QuickBooks

See the difference in the rates depending the payment type? This is what some service pros aren’t aware of. Here’s how much more service pros are paying for invoices and manual transactions under each platform than swiped transactions:

Service pros using Square are paying an additional 0.15% to get invoices processed and an additional 0.75% for manual key-in transactions.

Service pros using QuickBooks Online are paying as much as an additional 1.20% to get invoices processed and as much as an additional 1.60% for manual key-in transactions.

QuickBooks Desktop users are the worst off, paying as much as an additional 1.70% to get invoices processed and as much as an additional 1.70% for manual key-in transactions.

All payment processors also charge a per transaction fee on top of the rates shown above.

Service pros using Square don’t pay anything additional for swiped transactions, but pay $0.30 for every invoice and $0.15 for every manual transaction.

Service pros using QuickBooks Online pay $0.25 no matter the payment type (invoice, swiped or manual transaction).

Service pros using QuickBooks Desktop pay $0.30 across the board as well.

There’s a Better Way

Luckily, service pros don’t have to continue paying high rates for credit card processing.

With mHelpDesk Payments, service pros get the lowest transaction rate in the market: 2.89% + $0.30 per transaction for all credit cards and 1% + $0.30 per transaction for ACH (bank) payments.

mHelpDesk Payments is a fully functioning payment processing system that’s included with any mHelpDesk account. It’s integrated with the mHelpDesk web and mobile app, which means you can manage your invoices and customer payments all in one place.

How are we able to offer a market-leading rate? We partnered with Chase to bring down our rate for our users. With mHelpDesk Payments, you also don’t have to worry about setup, monthly or hidden fees.

In addition to Square and QuickBooks, we beat Paypal, Stripe and Authorize.net and even other field service software.

You Save the Most Money with mHelpDesk Payments

Let’s look at an example of just how much you can save with mHelpDesk Payments. Say your business is sending out 40 invoices each week and billing each customer $200.

If you were using Quickbooks, you’d be charged 3.50% + $0.30 per transaction, so you’d be paying $7.30 for each $200 invoice. Multiply that by 40 invoices and you’ll be charged $244 each week. In a year’s time, you’re out of $15,184.

Now, compare this to our rate, 2.89% + $0.30 per transaction. Doing the math, the difference in the rates can’t be ignored.

Here’s the breakdown: you’ll pay $6.08 for each $200 invoice. In a week, for the 40 invoices, you’ll pay $243 and in a year, that’ll add up to $12,646, which gives you an extra $2,538 in your pocket for other business expenses or priorities.

The Bottom Line

The “low” rates companies advertise can be misleading. Service pros need to do their homework and understand how much they are being charged for every kind of transaction that’s processed or risk underestimating their processing expenses, which can have a big impact on a business.

Are you an mHelpDesk customer, but haven’t signed up for mHelpDesk Payments?

Setup takes less than 10 minutes! Learn how here and then login to your account >>

New to mHelpDesk? Start your free trial and try mHelpDesk Payments today!

Last Updated By: Rochelle Sanchirico

Field Service Automation

Service Solutions

Last modified: June 19, 2019